Ethereum has been on a remarkable rally over the past few weeks. Since the start of July, when the asset was trading closer to ~$220, ETH has literally doubled. It trades just shy of $440 as of this article’s writing, flat in the past 24 hours.

Although some see this move as an impulsive surge that isn’t sustainable, on-chain metrics show that Ethereum is in a good spot. They add to the positive technical signals ETH has formed over recent months.

Related Reading: Crypto Tidbits: MicroStrategy’s $250m Bitcoin Purchase, Ethereum DeFi Boom, BitMEX KYC

Ethereum’s On-Chain Fundamentals Are Bullish

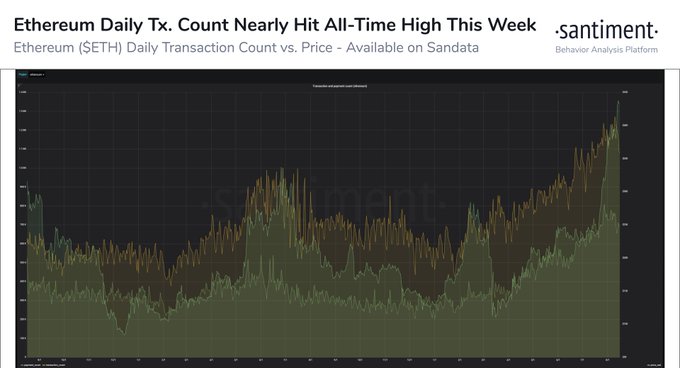

According to Santiment, a blockchain analytics firm, Ethereum is a good place in terms of its fundamentals. The company noted in an August 16th analysis that two pivotal on-chain metrics are nearing or are at all-time highs:

“The $ETH daily transaction count neared an all-time high this week. Its ATH of 1.34M was set back on Jan 4, 2018 when #Ethereum had an average market price of $1,042. Earlier this week its transaction count was within shouting distance at 1.27M. $ETH transaction fees also broke all-time highs two days in a row, with fees of 17.8k $ETH (8/12) and 20.3k $ETH (8/13).”

Chart of ETH's price action with the number of daily transactions from Santiment, a blockchain analytics firm.

Santiment claims that these two metrics reaching these levels “is a good long-term sign of things to come for #Ethereum holders.”

Tangentially related to this, analysts have found that there is somewhat of a correlation between Ethereum network activity and the value of ETH. This is likely due to the fact that to send transactions interacting with Ethereum, ETH must be spent.

Related Reading: Is Bitcoin Really In a Bull Market? Here’s Why Analysts Think BTC Isn’t

Technicals Corroborate Expectations of Upside

Technical analysts also think Ethereum is in a good spot from a short-term and longer-term perspective.

As reported by NewsBTC, the head of technical analyst at Blockfyre, a cryptocurrency research firm, said:

“$ETH looking ready for another leg up imo. $450 weekly resistance up next on the plate. Wouldn’t be surprised to see a lot of this alt money flow into Eth and see some healthy corrections across the board short term. Reducing some exposure to move to Eth.”

On Ethereum’s long-term outlook, the same trader who predicted the point at which BTC would bottom in 2019, noted recently that ETH has upside because its one-month MACD has crossed into the green.

Related Reading: Crypto Tidbits: Goldman Stablecoin, Dave Portnoy Wants Bitcoin, DeFi Boom

Photo by Etienne Girardet on Unsplash Price tags: ethusd, ethbtc Charts from TradingView.com These 2 On-Chain Signs Suggest Ethereum's Long-Term Trend Is Positive